Tin: The Silvery Soldier of Modern Technology

Tin, with its lustrous silver glow and remarkable malleability, might seem like a modest metal, but its applications are as diverse as they are essential. From food cans and electronics to solder and renewable energy technologies, tin plays a vital role in our modern world. Let’s delve into the intricacies of tin, exploring its sources, applications, and key considerations for international traders and buyers.

Description:

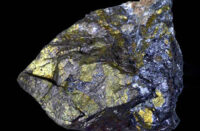

Tin primarily exists in cassiterite ore, a tin oxide mineral. Extracting the metal involves a multi-step process, including mining, crushing, milling, and flotation or smelting techniques. Cassiterite content in ore typically ranges from 2% to 7%, impacting processing costs and overall yield.

Key Source Countries:

- Indonesia: The world’s leading producer, boasting vast tin reserves and established mining operations. Over 25% of global tin production originates from Indonesia.

- China: Second-largest producer, contributing around 18% of global output. Key production regions include Yunnan and Guangxi.

- Myanmar: Holds approximately 10% of the global market share, with major production areas like Mawlamyinegyan.

- Peru: Significant producer, accounting for over 8% of global output. Puno and Madre de Dios hold extensive tin deposits.

- Other notable producers: Bolivia, Rwanda, Democratic Republic of Congo, Brazil, and Australia contribute to the remaining global production.

World Output Volumes:

Global tin production reached approximately 350,000 tonnes in 2023, showcasing modest growth over the past decade. Indonesia and China remain dominant forces, while other major producers continue to explore expansion opportunities. Fluctuations in demand and supply dynamics, particularly from Indonesia, can cause price volatility.

Major Producers and Market Share:

- Yunnan Tin Corporation: The world’s largest producer, controlling roughly 12% of the global market. Operates extensive mines and smelters in China.

- Antam: Indonesian state-owned company, accounting for around 8% of global output. Focuses on responsible mining practices and efficient production processes.

- Minsur SA: Peruvian mining giant, contributing approximately 7% of global tin production. Renowned for its high-quality tin concentrates.

- Bisnisindo Group: Indonesian company with significant tin production, holding around 5% of the global market share.

- Other major producers: Thailand Smelting Company, Bumi

Resources Minerals, Minsaco, Zhejiang Xiangfan Tin Industry Group, and numerous smaller players contribute to the remaining market share.

Forms of Trade:

Tin is primarily traded in two forms:

- Tin ingots: Large, refined blocks of pure tin (over 99.85% tin content). Used as raw material for downstream processing into various products.

- Tin alloys: Tin combined with other metals like copper, silver, or antimony for enhanced solderability, strength, or specific properties. Used in electronics, food packaging, and other applications.

Price Trends (Past 5 Years):

Tin prices have experienced significant fluctuations over the past five years:

- 2019: Prices hovered around $20,000 per tonne due to balanced supply and demand.

- 2020: Pandemic disruptions caused a decrease to around $16,000 per tonne before recovering moderately.

- 2021: Surging demand for electronics and solder, coupled with supply chain disruptions, pushed prices to over $35,000 per tonne.

- 2022: Prices corrected downwards to around $30,000 per tonne due to concerns about slowing global growth and rising energy costs.

- 2023: Prices maintained some volatility, ranging between $27,000 and $32,000 per tonne, influenced by geopolitical tensions and the pace of economic recovery.

Major Importing Countries:

- China: Despite being a major producer, China also imports significant volumes of tin (around 20% of its consumption) to meet its growing domestic demand for electronics and solder.

- United States: Major importer, primarily reliant on Indonesia and Malaysia for its tin supply.

- European Union: Collectively a significant importer, driven by demand in the electronics and packaging sectors.

- Japan: Major importer, relying on Southeast Asian countries for its tin consumption.

- India: Growing domestic demand necessitates substantial tin imports, mainly from Myanmar and Indonesia.

Major Exporting Countries:

- Indonesia: Dominant exporter, accounting for approximately 30% of global tin exports.

- Myanmar: Significant exporter, contributing around 20% of global tin trade.

- Peru: Exports around 15% of its tin production, playing a key role in South

Considerations for International Traders and Buyers of Tin:

Navigating the tin market requires careful consideration of various factors due to its essential role in electronics, packaging, and emerging technologies. Here are some key points for international traders and buyers:

Demand Fluctuations:

- Electronics: Monitor trends in global electronics production and the evolving landscape of miniaturization, which could impact tin demand.

- Food packaging: Stay informed about regulations and consumer preferences affecting the use of tinplate in food packaging.

- Renewable energy: Explore the potential impact of tin-based energy storage technologies on future demand.

Supply Chain Risks:

- Geopolitical tensions: Disruptions in major producing countries like Indonesia or Myanmar can significantly impact supply and prices.

- Mining regulations: Stringent environmental and ethical mining regulations can affect production costs and potential supply disruptions.

- Infrastructure limitations: Inadequate transportation infrastructure in some regions can hinder efficient export capabilities.

Quality Variations:

- Tin content: Understand the exact percentage of tin (typically ranging from 99.85% to 99.99% to ensure it meets downstream processing requirements.

- Impurities: Analyze the presence of impurities like iron, arsenic, and antimony, as they can influence the metal’s suitability for specific applications.

- Form and specification: Choose between tin ingots, solder pastes, powders, or specific alloy compositions depending on your end-use needs.

Price Volatility:

- Hedging strategies: Employ hedging instruments like options and futures contracts to mitigate price fluctuations, especially for long-term projects.

- Market analysis: Track key economic indicators and industry trends to anticipate potential price movements.

- Cost flexibility: Factor in potential price volatility when calculating project costs and margins.